Former Pfizer Employee Convicted At Trial of Insider Trading

India-West News Desk

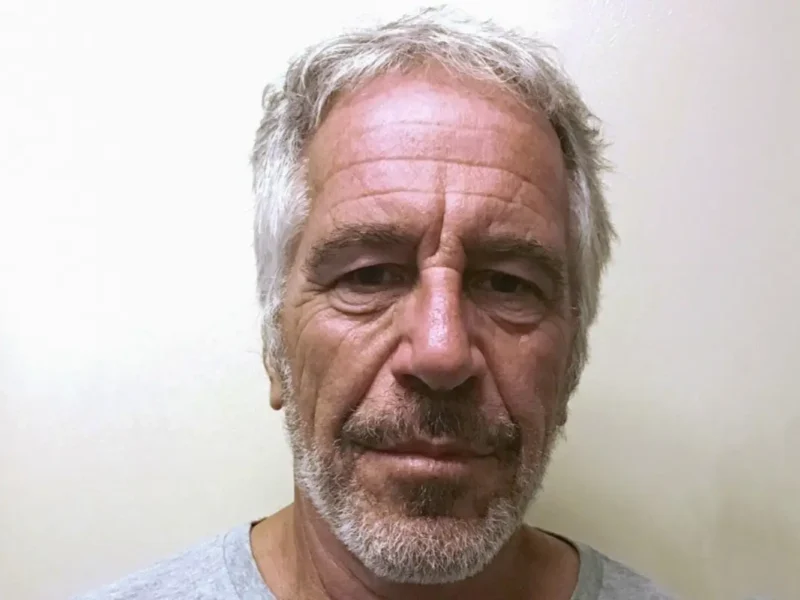

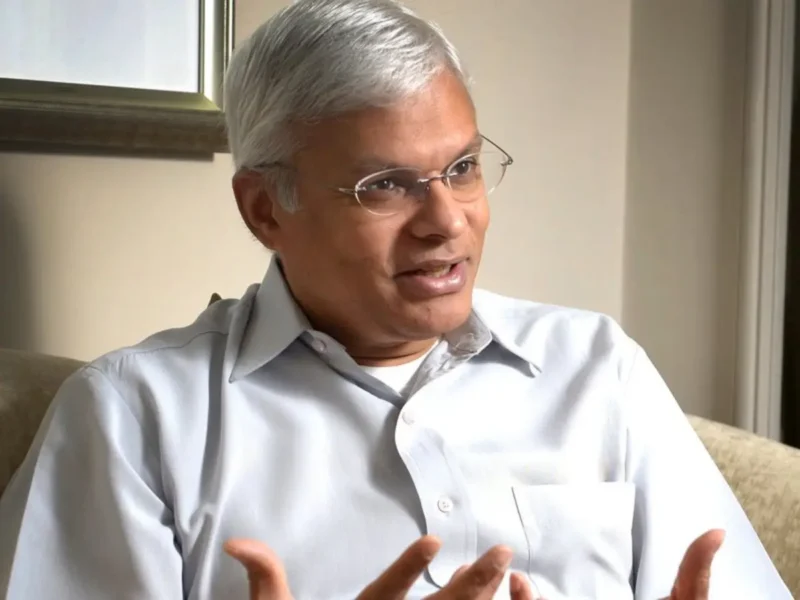

NEW YORK, NY – Damian Williams, the United States Attorney for the Southern District of New York, said that a jury has returned a guilty verdict against Amit Dager for insider trading and conspiracy to commit insider trading. The defendant was found guilty following a two-week trial before U.S. District Judge Andrew L. Carter.

Williams said, “As the jury’s swift verdict shows, the proof at trial was overwhelming that Amit Dagar stole information about Paxlovid from his employer, Pfizer, and used that illegal edge to profit in the stock market. Combatting the corruption of our financial markets continues to be a top priority of this Office. Would-be insider traders tempted by the prospect of easy money should know that the Southern District of New York is watching, we’ll catch you, and we’ll make sure you pay the price for violating the law.”

In November 2021, Dagar participated in an insider trading scheme to reap illicit profits from options trading based on inside information about the results of clinical trials of Paxlovid, a medicine used to treat COVID-19. DAGAR was an employee of Pfizer Inc. (“Pfizer”) and assisted in managing the data analysis in certain clinical drug trials.

He learned that a Pfizer trial of the drug Paxlovid, a medicine designed to treat mild to severe COVID‑19 infection, had produced positive results. The results were confidential and meant to remain so until Pfizer publicized them on November 5, 2021.

Later that same day, and while the results remained confidential, DAGAR purchased short-dated, out-of-the-money Pfizer call options that expired days and weeks later. Dagar also tipped a close friend, who also purchased short-dated, out-of-the-money Pfizer call options.

The following day, on November 5, 2021, Pfizer publicly released the results of its Paxlovid study prior to the market opening. That same day, following the publication of the positive results, Pfizer’s stock price increased substantially, opening — and eventually closing — more than 10% higher than the prior day’s closing price. In the following weeks, DAGAR sold his Pfizer call options for profits of more than $270,000.

Dagar, 44, of Hillsborough, NJ, was convicted of one count of securities fraud, which carries a maximum sentence of 20 years in prison, and one count of conspiracy to commit securities fraud, which carries a maximum sentence of five years in prison.

The maximum potential sentences are prescribed by Congress and are provided here for informational purposes only, as any sentencing of the defendant will be determined by the judge.