Founder Of HeadSpin Pleads Guilty To Securities Fraud

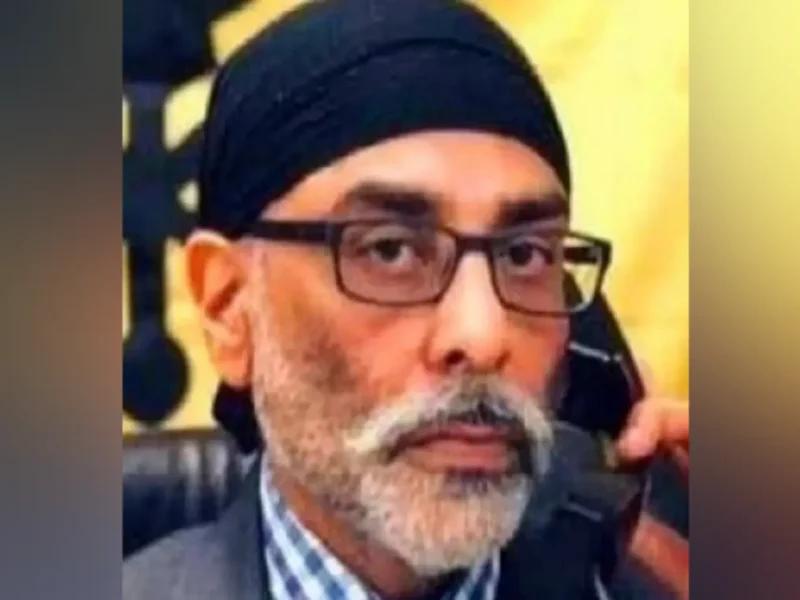

NEW YORK, NY (IANS) – A 47-year-old Indian American has pleaded guilty to wire and securities fraud charges in connection with his scheme to dupe potential investors into supporting the technology start-up he founded and led.

Manish Lachwani, who founded Silicon Valley-based HeadSpin in 2015 and served as its CEO until May 2020, was arrested, and charged in 2021 with defrauding investors by overstating the startup’s revenue and other key financial metrics.

Between April 2017 and April 2020, HeadSpin — which provided clients with software tools and access to devices to test mobile applications — raised more than $100 million from investors over multiple rounds of fundraising, leading to a valuation of approximately $1.1 billion.

According to his plea agreement, Lachwani admitted that he disseminated false and overstated revenue metrics to potential investors to lure investments into his company.

He acknowledged that while HeadSpin was raising money, he provided prospective investors information about the company’s business, customers, revenue, and finances, a Department of Justice release stated.

Further, because HeadSpin was a software-as-a-service company, Lachwani knew that Annual Recurring Revenue was significant to investors and their decisions about whether to invest in HeadSpin.

According to the plea agreement, Lachwani admitted that he provided prospective investors with inflated ARR numbers and overstated revenue numbers.

With respect to these metrics, Lachwani included amounts from potential customers that had not agreed to pay subscription fees to HeadSpin, amounts that were more than real customers had agreed to pay, and amounts from customers that had stopped using and paying for HeadSpin’s services.

Lachwani maintained and controlled an ARR spreadsheet that contained this false information and which he shared with potential investors.

In 2018, in connection with a round of fundraising, Lachwani sent a slide deck to investors that stated HeadSpin’s ARR was more than $33 million as of the second quarter of 2018, though he knew the company’s ARR was far less.

In 2019, during another round of fundraising, Lachwani again provided information to investors that overstated ARR, this time stating that HeadSpin’s ARR was $54 million when, in fact, it was far less.

Similarly, with respect to revenues, Lachwani sent invoices to HeadSpin’s accountant that Lachwani knew were altered to show amounts not actually invoiced to clients. HeadSpin investors received financial statements that were impacted by the altered invoices.

Pursuant to the plea agreement, Lachwani pleaded guilty to two counts of wire fraud and one count of securities fraud.

If he complies with the plea agreement, the remaining counts will be dismissed at sentencing. Lachwani is currently released on bond, and US District Judge Breyer scheduled his sentencing hearing for September 27. The maximum statutory penalty for each count of wire fraud is 20 years in prison and a fine of $250,000.

The maximum statutory penalty for securities fraud is 20 years in prison and a fine of $5 million, plus restitution if appropriate.

In addition, as part of the sentence Lachwani may be ordered to pay additional fines and to serve an additional term of supervised release after any prison sentence.