Trump’s Remittance Tax Will Boost U.S. Coffers, Cost India Billions

Visual: Via Center for Global Development

India -West News Desk

WASHINGTON D.C. – India is poised to face significant financial fallout from a newly implemented 1 percent tax on remittances—a key provision of President Donald Trump’s “Big, Beautiful Bill” that is already drawing international concern for its disproportionate impact on developing nations.

According to the Center for Global Development (CGD), the tax—effective nationwide—could cost India, Mexico, China, Vietnam, and several Latin American countries billions in lost income. The levy applies not only to foreign-born residents but also to U.S. citizens, a significant shift from earlier versions of the proposal, which targeted only non-citizens.

For countries like India, which receives tens of billions of dollars annually through remittances sent by its diaspora, the tax presents a dual blow: increased transfer costs and declining volumes. The CGD estimates that a 1 percent rise in remittance costs typically leads to a 1.6 percent decrease in the total amount sent, signaling potentially steep losses for families dependent on that income.

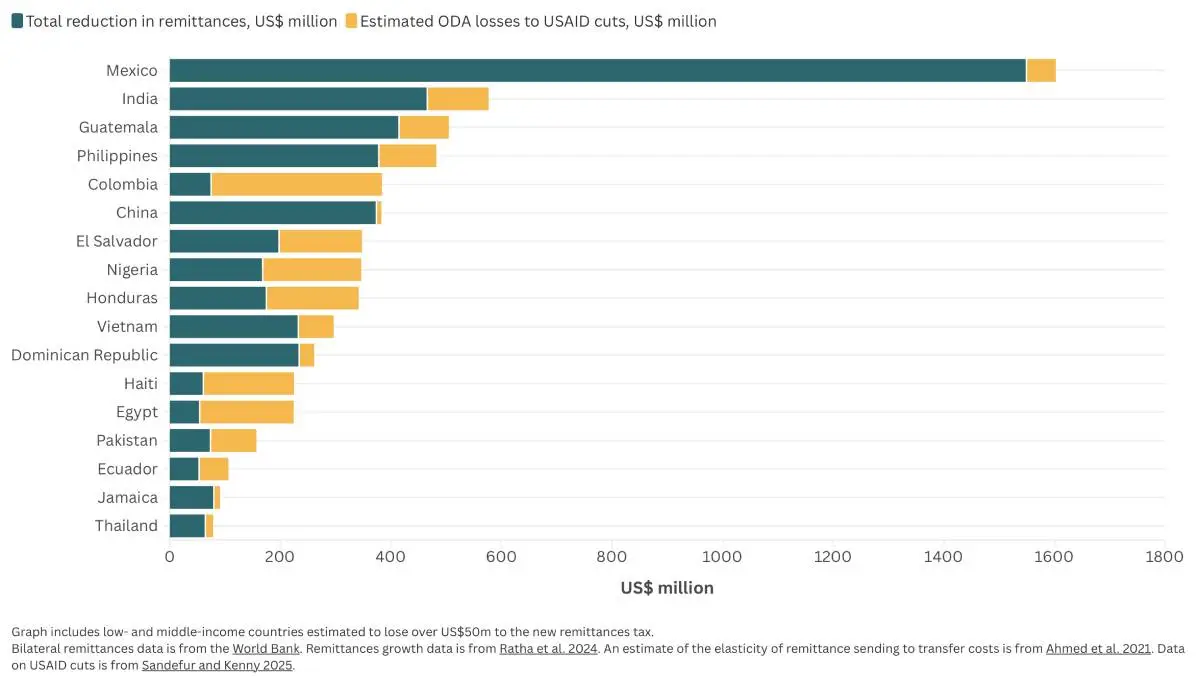

While Mexico is expected to be hit hardest in dollar terms—projected to lose over $1.5 billion per year—India and other large remittance-receiving nations could also face major economic ripple effects. For many households, remittances fund essentials such as education, housing, and healthcare, and serve as a key driver of consumption and currency stability.

The remittance tax has undergone several revisions since it was introduced in May 2025. Initially proposed as a 5 percent fee on transfers made by non-citizens, the plan faced backlash—particularly from the Mexican government—and was scaled down to 3.5 percent. The current 1 percent version expands the tax’s scope significantly, affecting an estimated 48 million foreign-born individuals, compared to 23 million under the earlier non-citizen-only version.

Though lower in rate, the broader reach could make the tax even more lucrative for U.S. coffers. If remittance volumes drop as projected, the CGD estimates the tax could bring in $4.5 billion annually—more than triple the $1.3 billion expected under the earlier, narrower proposal. If remittance behaviors remain unchanged, the government could collect as much as $4.6 billion from the 1 percent tax alone. Administration officials have floated a $10 billion revenue goal, though the likelihood of reaching it remains uncertain.

Notably, the tax exempts transfers made via U.S. banks, credit unions, and debit or credit cards, a carveout reportedly secured through lobbying by the financial services industry. However, that exemption may have limited effect. Industry data shows that roughly 80 percent of U.S. remittances to Latin America and the Caribbean are processed through money transfer operators—the very services still subject to the new tax. Similar patterns are seen in remittances sent to South and Southeast Asia.

For India, which received over $125 billion in remittances in 2023—the highest globally—the policy could translate into billions in lost income and increased burdens on migrant families, many of whom already pay high fees to send small amounts home.