DOJ Orders Release Of $5 Mln Man Convicted Of Fraud

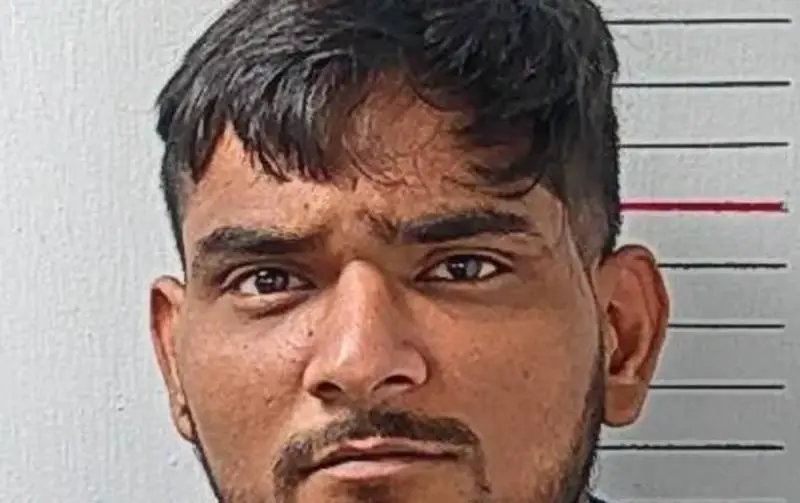

CHICAGO, IL (IANS) – A recent court ruling has mandated the release of nearly $5 million in assets seized by the US Department of Justice (DOJ) from Rishi Shah, a 37-year-old Indian American executive and co-founder of Chicago-based health technology startup Outcome Health. Shah was convicted in April for his role in a massive corporate fraud scheme that defrauded the company’s clients, lenders, and investors of over $1 billion.

The ruling was delivered by a federal judge who determined that $4.9 million in assets should not have been frozen as they were acquired before the fraudulent activities transpired, according to the Chicago Business newspaper. Shah’s attorneys argued that this amount was incorrectly frozen and intended for his legal representation during sentencing and for a potential appeal.

The prosecution had initially frozen approximately $55 million in assets, consisting mainly of holdings in startups and investment funds, belonging to both Rishi Shah and Shradha Agarwal, the former president of Outcome Health who was also convicted in the fraud scheme.

While the government aimed to retain the frozen funds, asserting that they would be used for eventual restitution, no formal restitution order had been issued yet. US District Judge Thomas Durkin underscored that the law does not address a future restitution order and, therefore, ruled in favor of releasing the assets.

During the trial, Shah, who held around 80 percent of Outcome Health’s assets, had requested the return of $10 million from the frozen funds to cover legal expenses, a plea that was rejected.

Shah’s attorneys have raised questions about the government’s asset tracing methods and the potential miscalculation of the improperly frozen funds’ value, which may have appreciated since the seizure.

In the scheme, Outcome Health installed screens and tablets in physicians’ offices across the US, then sold advertising space to pharmaceutical companies. Shah and Agarwal inflated the billing amounts, leading to an artificial boost in the company’s financials. This manipulated data was then used to secure $488 million from investors and $435 million from lenders. Of this sum, Shah and Agarwal received approximately $69 million.

Shah, convicted on counts of mail fraud, wire fraud, bank fraud, and money laundering, is scheduled for sentencing in the fall. The case underscores the intricate challenges posed by white-collar crimes and the legal complexities surrounding asset forfeiture and restitution.